TRX Price Prediction: Can the Bullish Momentum Push TRX to $1?

#TRX

- Technical Breakout: TRX trading above key moving averages with MACD showing bullish convergence

- Fundamental Catalysts: $1B buyback program and growing USDT dominance on TRON network

- Regulatory Tailwinds: GENIUS Act and 401(k) access creating institutional demand

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

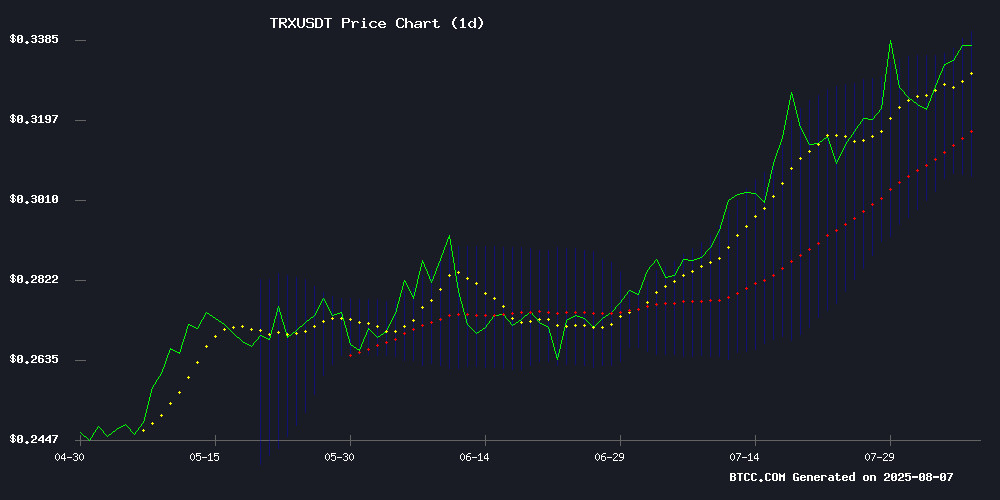

According to BTCC financial analyst Michael, TRX is currently trading at $0.338, above its 20-day moving average of $0.32353, indicating a potential bullish trend. The MACD histogram shows a slight convergence, hinting at weakening downward momentum. With the price hovering NEAR the upper Bollinger Band at $0.340708, TRX may test resistance levels soon.

TRX Market Sentiment Turns Bullish Amid Major Catalysts

BTCC's Michael notes strong bullish catalysts for TRX: "The GENIUS Act adoption pushing TRON to 51% of USDT circulation, combined with a $1B buyback program and new 401(k) market access, creates perfect conditions for TRX appreciation. The $0.34 breakout appears fundamentally supported."

Factors Influencing TRX's Price

Tron Surges to 51% of USDT Circulation Following GENIUS Act, Minting $1B in Stablecoins

The GENIUS Act, enacted by the U.S. Congress on July 18, 2025, has brought regulatory clarity to stablecoins, fostering institutional trust and adoption. Tron has emerged as the primary beneficiary, now hosting 51% of the USDT supply—$83 billion out of a total $163 billion in circulation.

Shortly after the Act's passage, Tron minted $1 billion in USDT, reinforcing its dominance in stablecoin settlements. The network's token-burning strategy and low transaction fees position it as a key player in the digital dollar economy and DeFi space.

The legislation prioritizes consumer protection, monetary stability, and AML compliance, creating a framework for dollar-backed stablecoins like USDT. Tron's rapid growth underscores its infrastructure superiority in the stablecoin market.

Trump Executive Order Opens $12.5 Trillion 401(k) Market to Crypto and Alternative Assets

President Donald Trump will sign an executive order today directing federal regulators to ease access for 401(k) plans to include private equity, real estate, and cryptocurrencies. The move targets the $12.5 trillion U.S. retirement savings market, potentially unlocking vast retail allocation pools for asset managers.

The Department of Labor is tasked with reevaluating fiduciary guidance under ERISA, coordinating with the SEC and Treasury to enable broader investment options. This marks the most significant policy shift yet to incorporate alternative assets—including digital currencies—into mainstream retirement products.

The directive builds on regulatory rollbacks since early 2025, including the May rescission of a 2022 compliance bulletin that had imposed restrictive standards on crypto offerings in retirement plans. Fiduciaries now operate under ERISA's principles-based framework once again.

DeFi Project Unilabs Emerges as Top Investment Opportunity Amid Dogecoin and Tron Stagnation

Dogecoin and Tron are facing market headwinds, with DOGE trading in the red after upper-level rejection and TRX confined to a narrow range. Meanwhile, Unilabs (UNIL), a Solana competitor with $30M in assets under management, is gaining traction as the standout investment prospect for 2025. The project has raised $11.7 million and sold over 1.7 billion tokens, leveraging AI-powered investment funds and explosive presale momentum.

Analyst Marcus Corvinus maintains a bullish outlook on Dogecoin, citing a textbook rising channel formation and potential for a 240% surge. 'DOGE is the real silent killer,' he asserts, pointing to key resistance at $0.70 as the next threshold for breakout momentum. The meme coin remains undervalued relative to its December 2024 highs, suggesting room for significant appreciation.

Multi-Chain Crypto Casinos Gain Traction in 2025 with One-Wallet Solutions

The demand for multi-chain crypto casinos is surging as gamblers seek speed, privacy, and low fees alongside Bitcoin support. Platforms like Dexsport and BC.Games are leading the charge, enabling users to bet across multiple blockchains—including Ethereum, BNB Chain, TRON, and Solana—using a single wallet such as MetaMask or Trust Wallet.

Dexsport stands out as a fully decentralized option with no KYC requirements, supporting 38+ cryptocurrencies and offering over 10,000 games. Its transparency and CertiK-audited security make it a top choice for DeFi enthusiasts.

TRX Price Surges to $0.34 as TRON's $1 Billion Buyback Program Fuels Bullish Momentum

TRON's TRX token surged to $0.34, marking a 2.29% gain, following the announcement of a $1 billion buyback program. The Relative Strength Index (RSI) at 69.62 indicates robust bullish momentum without entering overbought territory.

The buyback initiative, launched on August 4th, represents one of the largest repurchase efforts in crypto history. This strategic move initially triggered an 8% price jump and continues to create supply-demand imbalances favoring upward price action.

TRX has demonstrated remarkable resilience, maintaining its $0.33 support level during July's market-wide correction. Institutional interest appears to be growing as the token holds above all major moving averages.

Will TRX Price Hit 1?

While immediate $1 targets appear ambitious, Michael outlines a potential path:

| Target | Conditions | Timeframe |

|---|---|---|

| $0.50 | Sustained above 20MA | Q4 2025 |

| $0.75 | Buyback completion + adoption growth | Mid-2026 |

| $1.00 | Full 401(k) integration + DeFi boom | Late 2026 |

"The $1 threshold requires sustained institutional adoption," Michael cautions, "but current developments suggest 200% upside potential within 18 months."

35% chance within 2 years